Why forecasting is so important.

In a nutshell, running historical or current reports from your accounting system to review past performance is a very important part of preparing for the future. We encourage all of our clients to set a budget to help them achieve their goals in the future.

So what do we have have to review?

The profit and loss is often a great place to start. You can break it down in to 3 sections. Revenue or Sales , Cost of Goods Sold and overheads. You can get even more granular by breaking these down in to sub categories for closer scrutiny

Sales

- Are you undertaking any marketing initiatives, and what results do you expect?

- Do you have a pipeline of work that has been confirmed?

- Are there opportunities to capitalise in either internally or external to your business?

- Are there market pressures from technology changes or competition that can affect sales?

- When did you last review your prices?

It might be that historical sales are a good indicator of future sales. Is this enough for you? If not which levers do you need to pull to grow your business revenue.

Cost of Good Sold

This is essentially to cost of the item that you are selling. If your a builder for example and you undertake a job for $100,000 and it costs you $60,000 in materials and contractors, the ‘cost of goods sold’ is $60,000 the flip-side is the gross profit which is $40,000 or 40%.

These are essentially variable costs that should be monitored and reviewed regularly to ensure that you are achieving your target gross profit. Questions you should be asking are?

- Can i buy the same services or components else where at a more competitive price?

- Can i bundle my requirements to make the package more attractive to a supplier?

- Does my cash flow support paying early to take advantage of discounts that might be on offer?

- Are there more efficient ways of producing your product?

Overheads

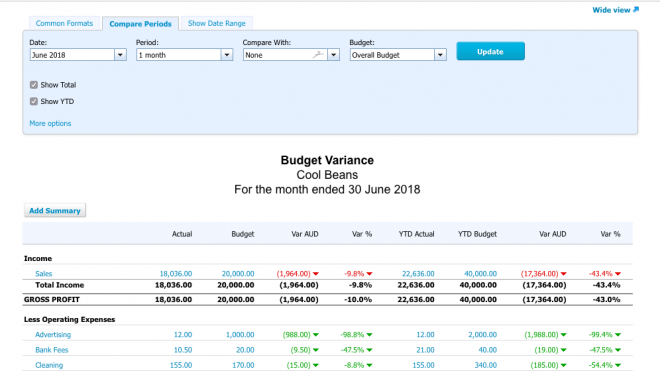

By grouping your overheads in to sub categories you can start to develop a real understanding of the running costs of your business at a higher level. If you identify areas that are over-budget you can start digging in to the account categories and working out why the expenses are higher or lower than expected.

- Is it a timing issue?

- Are they prepaid expenses?

- Can you bundle and save?

- Are your employee’s efficient? Do you have metrics around this to review such as revenue per employee?

- Are your occupancy costs inline with your forecast as a percentage of revenue? ie rent / sales

Your overheads and you gross margin will help you determine your breakeven point which we will touch on in a future topic

Xero has a great budgeting tool that allows you to enter an annual budget quickly and easily. The link below provides a video snap shot of how . There is the opportunity to update and review the budget , or to set a completely new budget .

Xero has made it really easy to start and enter data, and run reports on